Page 150 - ΝΑΥΤΙΚΑ ΧΡΟΝΙΚΑ - MARTIOS 2023

P. 150

FREIGHT MARKETS

As there are no evident signs that the

conflict between Russia and Ukraine

will end soon, the tanker market has

started to feel the impacts of the

EU’s oil ban on Russia. After prohib-

iting crude oil imports on 5 Decem-

ber 2022, the EU halted refined oil

imports on 5 February 2023, which

means that Russian oil can no longer

be carried by EU-owned vessels unless

the oil product is sold at or below the

agreed G7/EU price cap. It is notewor-

thy that Russia is Europe’s largest oil

product supplier. Europe’s reliance on

Russia is demonstrated by the fact that

Europe depends on Russia for 60% of

its diesel imports, a dependence that

rises to 70% for North-West Europe,

whereas, in the Mediterranean, only 25

% of diesel imports come from Russia.

If the cap works similarly to the crude

oil cap, global oil product flows will be

reshuffled, Europe will try to find alter-

native suppliers, and Russia must find

new customers for its refineries pro-

duction. Europe may turn to the US,

Middle East, and India for oil products,

adding tonne miles to the wet market,

operated in the Baltic during winter. thus reducing the supply of product

As far as Ice-classed tankers are con- vessels and strengthening the freight

cerned, we witnessed an increased rates. As for Russia, it may reduce its

buying appetite for such vessels. In refined product prices, as it has already

2022, around 136 Ice-class tankers done for crude oil, in an effort to find

changed hands (accounting for 20% of alternative customers.

the total tankers sales), nearly twice

the number of 2021’s Ice-class tanker

sales. M/T NISSOS RHENIA

318,744 dwt, BUILT 2019, Hyundai Heavy Industries Co., Ltd

2022 2021

Moving forward

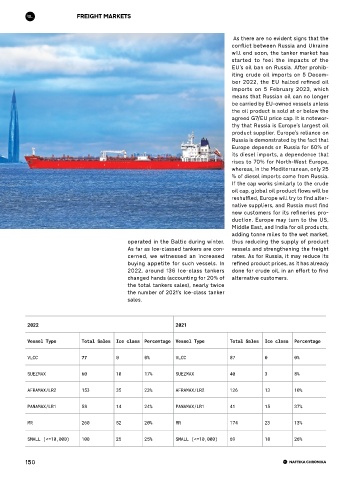

Vessel Type Total Sales Ice class Percentage Vessel Type Total Sales Ice class Percentage

with Confidence

VLCC 77 0 0% VLCC 87 0 0%

SUEZMAX 60 10 17% SUEZMAX 40 3 8%

AFRAMAX/LR2 153 35 23% AFRAMAX/LR2 126 13 10%

PANAMAX/LR1 58 14 24% PANAMAX/LR1 41 15 37%

Ethnarchou Makariou Av, & 2 D. Falireos Str.

MR 260 52 20% MR 174 23 13% 18547 Neo Faliro, Piraeus, Greece

T: +30 210 4804200 | F: +30 210 4818210 | E: crew@kykmar.gr

SMALL (<=10,000) 100 25 25% SMALL (<=10,000) 69 18 26%

www.kykmar.gr

150