Page 149 - ΝΑΥΤΙΚΑ ΧΡΟΝΙΚΑ - MARTIOS 2023

P. 149

FREIGHT MARKETS

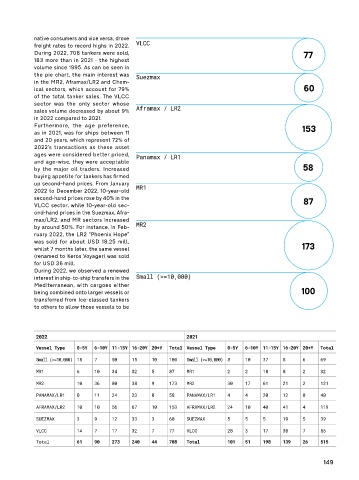

Russia’s invasion of Ukraine in February 2022 was at the core of a new global crisis at a native consumers and vice versa, drove

time when the global economy hadn’t recovered yet from the pandemic disruptions and lock- freight rates to record highs in 2022. VLCC

downs. The sanctions against Russia that followed sent energy prices soaring - in March During 2022, 708 tankers were sold, 77

2022, the WTI climbed to $120/barrel, the highest level since August 2008 - and triggered 183 more than in 2021 - the highest

a wave of inflation the likes of which the global economy had not seen for decades. volume since 1995. As can be seen in

the pie chart, the main interest was Suezmax

in the MR2, Aframax/LR2 and Chem-

ical sectors, which account for 79% 60

of the total tanker sales. The VLCC

sector was the only sector whose

sales volume decreased by about 9% Aframax / LR2

in 2022 compared to 2021.

THE EFFECTS Furthermore, the age preference, 153

as in 2021, was for ships between 11

OF THE and 20 years, which represent 72% of

2022’s transactions as these asset

UKRAINE WAR ages were considered better priced, Panamax / LR1

and age-wise, they were acceptable

ON THE TANKER by the major oil traders. Increased 58

buying appetite for tankers has firmed

MARKET up second-hand prices. From January MR1

2022 to December 2022, 10-year-old

second-hand prices rose by 40% in the 87

VLCC sector, while 10-year-old sec-

ond-hand prices in the Suezmax, Afra-

max/LR2, and MR sectors increased

by around 50%. For instance, in Feb- MR2

ruary 2022, the LR2 “Phoenix Hope”

was sold for about USD 18.25 mill,

whilst 7 months later, the same vessel 173

(renamed to Keros Voyager) was sold

for USD 36 mill.

During 2022, we observed a renewed

interest in ship-to-ship transfers in the Small (>=10,000)

Mediterranean, with cargoes either

Europe’s gradual moving away from pandemic, many refineries were shut being combined onto larger vessels or 100

Russian oil has benefited the Suez- down due to the declining demand transferred from Ice-classed tankers

max and Aframax markets, given the and low oil consumption, triggering to others to allow those vessels to be

short-and medium-haul demand for issues in many countries, especially in

North Sea, West Africa, and US crude. Europe, and pushing the seaborne oil

On 18 February 2022, just one week trade mainly from East of Suez to the

before the Russian-Ukraine conflict West. As a result, clean tankers bene- 2022 2021

commenced, the Aframax TCE paid fited from the increase in tonne miles.

USD 4,411/day. However, by the end of For example, on 18 February 2022, the Vessel Type 0-5Y 6-10Y 11-15Y 16-20Y 20+Y Total Vessel Type 0-5Y 6-10Y 11-15Y 16-20Y 20+Y Total

2022, it had risen significantly to USD MR Pacific Basket and the MR Atlantic Small (>=10,000) 18 7 50 15 10 100 Small (>=10,000) 8 10 37 8 6 69

73,004/day after peaking at around Basket paid USD 7,969/day and USD

USD 125K/day at the end of Novem- 15,658/day, respectively. However, by MR1 6 10 34 32 5 87 MR1 2 2 18 8 2 32

ber 2022. the end of 2022, those rates surged

Furthermore, the Suezmax TCE rate to USD 57,851/day and USD 35,964/ MR2 10 36 80 38 9 173 MR2 30 17 61 21 2 131

was negative, reaching USD -1,820/ day, respectively. PANAMAX/LR1 0 11 24 23 0 58 PANAMAX/LR1 4 4 20 12 0 40

day in mid-February 2022, while it The booming of the tanker market,

closed the year at USD 83,640/day. driven by the Russian invasion of AFRAMAX/LR2 10 10 56 67 10 153 AFRAMAX/LR2 24 10 40 41 4 119

Another boost for the wet market was Ukraine and sanctions on Russian oil, SUEZMAX 3 9 12 33 3 60 SUEZMAX 5 5 5 19 5 39

by Eirini Diamantara, that refineries increased production as led the second-hand tanker market to

Research Analyst, they imported great volumes of crude heat up in 2022. High oil prices and VLCC 14 7 17 32 7 77 VLCC 28 3 17 30 7 85

Research & Valuations Dept. oil due to the post-pandemic recov- the increase in tonne miles, triggered

Xclusiv Shipbrokers Inc. Total 61 90 273 240 44 708 Total 101 51 198 139 26 515

ery of oil consumption. But during the by oil suppliers’ efforts to find alter-

148 149