Page 279 - ΝΑΥΤΙΚΑ ΧΡΟΝΙΚΑ - ΜΑΙΟΣ 2024

P. 279

TANKER MARKET despite the holiday season. This indicated ship-

owners’ confidence in methanol as a fuel for a

Freight Market future with lower carbon emissions. In February,

In January, the global crude tanker map and flows the newbuilding market experienced a slowdown

underwent another restructuring due to the ongo- compared to the robust activity seen in the sale

ing Red Sea crisis and recent international sanc- and purchase (S&P) market during this period.

tions against Russia. OPEC projects an increase In March, tanker ordering, especially for VLCCs,

in global oil demand driven by the booming Chi- surged, led by Greek companies investing in envi-

nese economy. The ongoing Red Sea crisis has ronmentally friendly vessels with scrubbers and

benefited the product tanker market due to the LNG capabilities. Robust sale and purchase (S&P)

increased diesel and fuel supplies to the EU. How- activity, particularly in the Capesize and Newcas-

ever, freight costs, delivery times, and product tlemax segments, highlighted the Greek buyers’

prices have been dramatically impacted. predominance.

In February, the tanker market recorded high In April, there was a noticeably strong demand

freight rates, especially in the product sector, for modern tankers, as indicated by the increased

marking a departure from previous downward shipbuilding activity and high interest in vessels

trends. This surge was primarily attributed to the for sale.

ongoing crisis in the Middle East and rising bun-

Demolitions

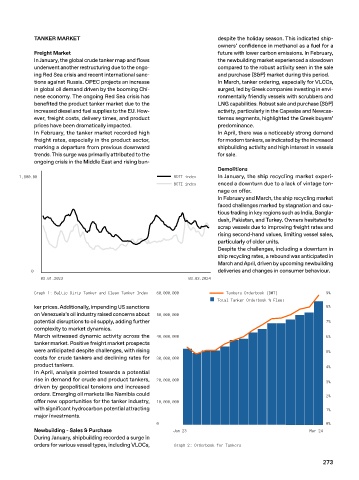

1,800.00 BDTI index In January, the ship recycling market experi-

BCTI index enced a downturn due to a lack of vintage ton-

nage on offer.

In February and March, the ship recycling market

faced challenges marked by stagnation and cau-

tious trading in key regions such as India, Bangla-

desh, Pakistan, and Turkey. Owners hesitated to

scrap vessels due to improving freight rates and

rising second-hand values, limiting vessel sales,

particularly of older units.

Despite the challenges, including a downturn in

ship recycling rates, a rebound was anticipated in

March and April, driven by upcoming newbuilding

0 deliveries and changes in consumer behaviour.

03.01.2023 03.03.2024

Graph 1: Baltic Dirty Tanker and Clean Tanker Index 60,000,000 Tankers Orderbook (DWT) 9%

Total Tanker Orderbook % Fleet

ker prices. Additionally, impending US sanctions 8%

on Venezuela’s oil industry raised concerns about 50,000,000

potential disruptions to oil supply, adding further 7%

complexity to market dynamics.

March witnessed dynamic activity across the 40,000,000 6%

tanker market. Positive freight market prospects

were anticipated despite challenges, with rising 5%

costs for crude tankers and declining rates for 30,000,000

product tankers. 4%

In April, analysis pointed towards a potential

rise in demand for crude and product tankers, 20,000,000 3%

driven by geopolitical tensions and increased

orders. Emerging oil markets like Namibia could 2%

offer new opportunities for the tanker industry, 10,000,000

with significant hydrocarbon potential attracting 1%

major investments.

0 0%

Newbuilding - Sales & Purchase Jan 23 Mar 24

During January, shipbuilding recorded a surge in

orders for various vessel types, including VLOCs, Graph 2: Orderbook for Tankers

273