Page 284 - ΝΑΥΤΙΚΑ ΧΡΟΝΙΚΑ - ΜΑΙΟΣ 2024

P. 284

FREIGHT MARKETS

LNG/LPG MARKET respond to 13.5% and 14.3%, respectively, of the

tonnage under construction. The fleet of LNG car-

Freight Market riers increased to 751 units with a capacity of 112.5

Given that supply dynamics are anticipated to million m3 as of the beginning of 2024. This comes

have an effect, the LNG shipping market may after 41 units of 5.7 million ft3 capacity were deliv-

be entering a period of lower freight rates. In ered in 2023. Ten vessels with a capacity of 1.1 mil-

2023, the United States emerged as the leading lion ft3, consisting of three conversions and seven

supplier of gaseous fuel, with being by far the demolition sales, were removed from the fleet.

largest importer. Due to very firm contracting in recent years, a

The main factor driving these gains is that freight record 89 vessels with a capacity of 13.2 million m3

rates are still high enough to offset the costs of are scheduled for delivery this year. With only two

rerouting ships out of the troubled Red Sea, units in the small LNG carrier sector, contracting

where attacks on commercial vessels continue. activity is still minimal. Following the delivery of

It is not expected that the shipping industry will eight units totalling 1.3 million m3, the LNG carrier

experience major structural changes despite fleet increased to 760 units at the beginning of

these difficulties. March, or 113.9 million m3, representing a 1.2%

In April, rates for vessels of around 160,000 cubic capacity increase since the beginning of the year.

meters held firm at $35,000 per day in both the In April, a surge in LNG carrier orders, particularly

eastern and western regions of the Suez Canal, at the Hanwha Ocean shipyard in South Korea,

marking the lowest levels in about a year. The saw contracts for 12 vessels secured in a short

period also witnessed notable shifts in LNG trade time span.

routes and demand patterns, characterised by

increased imports in Asia contrasted with sub- Demolitions

dued imports in Europe. As of July 2023, no ships have been sold for scrap,

indicating that LNG carrier demolition is still

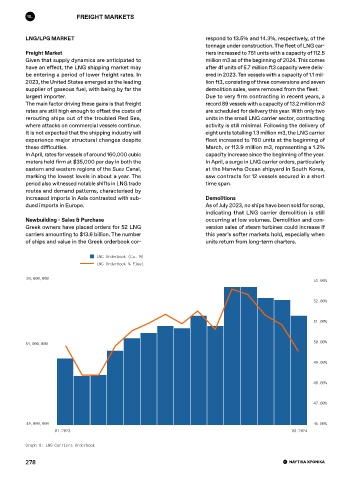

Newbuilding - Sales & Purchase occurring at low volumes. Demolition and con-

Greek owners have placed orders for 52 LNG version sales of steam turbines could increase if

carriers amounting to $13.6 billion. The number this year’s softer markets hold, especially when

of ships and value in the Greek orderbook cor- units return from long-term charters.

LNG Orderbook (Cu. M)

LNG Orderbook % Fleet

59,000,000 53.00%

52.00%

51.00%

54,000,000 50.00%

49.00%

48.00%

47.00%

49,000,000 46.00%

01.2023 03.2024

Graph 8: LNG Carriers Orderbook

278