Page 282 - ΝΑΥΤΙΚΑ ΧΡΟΝΙΚΑ - ΜΑΙΟΣ 2024

P. 282

FREIGHT MARKETS

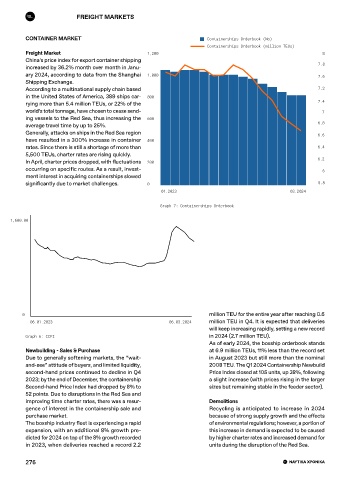

CONTAINER MARKET Containerships Orderbook (No)

Containerships Orderbook (million TEUs)

Freight Market 1,200 8

China’s price index for export container shipping

increased by 36.2% month over month in Janu- 7.8

ary 2024, according to data from the Shanghai 1,000 7.6

Shipping Exchange.

According to a multinational supply chain based 7.2

in the United States of America, 389 ships car- 800

rying more than 5.4 million TEUs, or 22% of the 7.4

world’s total tonnage, have chosen to cease send- 7

ing vessels to the Red Sea, thus increasing the 600

average travel time by up to 25%. 6.8

Generally, attacks on ships in the Red Sea region 6.6

have resulted in a 300% increase in container 400

rates. Since there is still a shortage of more than 6.4

5,500 TEUs, charter rates are rising quickly.

In April, charter prices dropped, with fluctuations 200 6.2

occurring on specific routes. As a result, invest- 6

ment interest in acquiring containerships slowed

significantly due to market challenges. 0 5.8

01.2023 03.2024

Graph 7: Containerships Orderbook

1,600.00

0 million TEU for the entire year after reaching 0.6

06.01.2023 06.03.2024 million TEU in Q4. It is expected that deliveries

will keep increasing rapidly, setting a new record

Graph 6: CCFI in 2024 (2.7 million TEU).

As of early 2024, the boxship orderbook stands

Newbuilding - Sales & Purchase at 6.9 million TEUs, 11% less than the record set

Due to generally softening markets, the “wait- in August 2023 but still more than the nominal

and-see” attitude of buyers, and limited liquidity, 2008 TEU. The Q1 2024 Containership Newbuild

second-hand prices continued to decline in Q4 Price Index closed at 105 units, up 38%, following

2023; by the end of December, the containership a slight increase (with prices rising in the larger

Second-hand Price Index had dropped by 8% to sizes but remaining stable in the feeder sector).

52 points. Due to disruptions in the Red Sea and

improving time charter rates, there was a resur- Demolitions

gence of interest in the containership sale and Recycling is anticipated to increase in 2024

purchase market. because of strong supply growth and the effects

The boxship industry fleet is experiencing a rapid of environmental regulations; however, a portion of

expansion, with an additional 8% growth pre- this increase in demand is expected to be caused

dicted for 2024 on top of the 8% growth recorded by higher charter rates and increased demand for

in 2023, when deliveries reached a record 2.2 units during the disruption of the Red Sea.

276