Page 159 - ΝΑΥΤΙΚΑ ΧΡΟΝΙΚΑ - MARTIOS 2023

P. 159

ANALYSIS

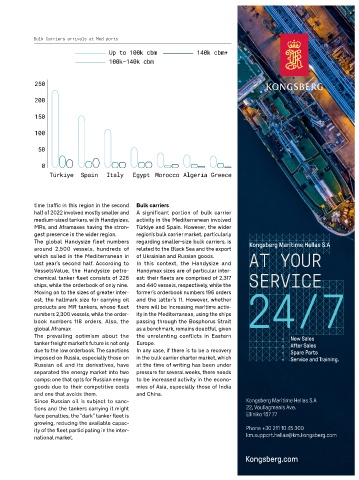

LPG Carrier arrivals at Med ports Bulk Carriers arrivals at Med ports

Up to 15k cbm 25k-50k 61k + Up to 100k cbm 140k cbm+

15k - 26k 50k-61k 100k-140k cbm

250

250

200

200

150

150

100

100

50

50

0

0

Algeria Italy Spain Türkiye Morocco Greece Türkiye Spain Italy Egypt Morocco Algeria Greece

The destination of LPG carriers with a vided exclusively to Naftika Chronika, time traffic in this region in the second Bulk carriers

capacity of 61,000 m3 and above were the LNG carrier orderbook numbers 327 half of 2022 involved mostly smaller and A significant portion of bulk carrier

mainly Turkey and Morocco. ships, the largest of which has a capac- medium-sized tankers, with Handysizes, activity in the Mediterranean involved

ity of 267,000. Given that the global MRs, and Aframaxes having the stron- Türkiye and Spain. However, the wider

Bulk Carriers LNG carrier fleet numbers 671 vessels, gest presence in the wider region. region’s bulk carrier market, particularly

Based on the MarineTraffic data, in the the orderbook to fleet ratio is 49%. The global Handysize fleet numbers regarding smaller-size bulk carriers, is

second half of 2022, there were 20,091 Furthermore, most newbuilds entering around 2,500 vessels, hundreds of related to the Black Sea and the export

arrivals of Handysize, Handymax and the global fleet will have a carrying which sailed in the Mediterranean in of Ukrainian and Russian goods.

Panamax bulk carriers in Mediterra- capacity equal to or exceeding 174,000 last year’s second half. According to In this context, the Handysize and

nean and French non-Mediterranean cubic meters. The way the LNG carrier VesselsValue, the Handysize petro- Handymax sizes are of particular inter-

ports. The bulk of the activity concerned market is evolving shows that it is rap- chemical tanker fleet consists of 226 est: their fleets are comprised of 2,317

Handysizes, which accounted for 76% of idly moving away from smaller or medi- ships, while the orderbook of only nine. and 440 vessels, respectively, while the

total arrivals. um-sized ships towards larger vessels, Moving on to the sizes of greater inter- former’s orderbook numbers 196 orders

The top Mediterranean country in terms or even the massive Q-Max, primarily est, the hallmark size for carrying oil and the latter’s 11. However, whether

of bulk carrier arrivals was Türkiye, which ordered by companies aiming to accom- products are MR tankers, whose fleet there will be increasing maritime activ-

demonstrates the strong presence of modate Qatar’s export needs. numbers 2,300 vessels, while the order- ity in the Mediterranean, using the ships

bulk carriers in the Eastern Mediterra- The next day for the LNG carrier book numbers 118 orders. Also, the passing through the Bosphorus Strait

nean. market promises to be interesting: global Aframax as a benchmark, remains doubtful, given

With China heading into a summer of The prevailing optimism about the the unrelenting conflicts in Eastern

THE FLEET, THE ORDERBOOK, extreme weather, its demand for LNG tanker freight market’s future is not only Europe.

AND THE SHORT-TERM OUTLOOK is expected to be high. At the same due to the low orderbook. The sanctions In any case, if there is to be a recovery

time, Europe remains “locked” in LNG imposed on Russia, especially those on in the bulk carrier charter market, which

LNG carriers imports, so a possible “rivalry” between Russian oil and its derivatives, have at the time of writing has been under

The significant presence of LNG carriers Europe and China over LNG cargoes separated the energy market into two pressure for several weeks, there needs

in the Mediterranean was evident during cannot be ruled out. It remains to be camps: one that opts for Russian energy to be increased activity in the econo-

the previous year, with many of them seen whether supply in the global goods due to their competitive costs mies of Asia, especially those of India

having the ports of European Union market and the number of ships in the and one that avoids them. and China.

countries as their destination. How- LNG carrier fleet will be enough to pre- Since Russian oil is subject to sanc-

ever, Europe’s broader shift away from vent another boom in energy prices. tions and the tankers carrying it might

Russia’s pipelines and gas has caused face penalties, the “dark” tanker fleet is

confusion in the energy market and a Tankers growing, reducing the available capac-

significant appetite for new orders. Focusing on the Mediterranean as our ity of the fleet participating in the inter-

According to VesselsValue’s data pro- area of interest, it is evident that mari- national market.

158 159