Page 141 - ΝΑΥΤΙΚΑ ΧΡΟΝΙΚΑ - MARTIOS 2023

P. 141

FREIGHT MARKETS

and pushed the market into contango. onstream in approximately 4 to 5 years C

Seeking to capture this contango and and create fresh demand for newbuild M

not sell their cargoes at a prompt dis- vessels in 2027-2028. In the meantime, Y

count, market participants started the record number of vessels already on CM

floating their cargoes for long periods. order will be delivered in time to cover

MY

Indicatively, at some point in November, production that will come on stream from

more than 40 vessels were floating out- the previous round of under-construc- CY

side the EU, waiting to discharge at the tion projects. These under-construction CMY

right time. That significantly increased mega projects are set to commence K

tonne-time (utilisation) and kept vessels production between 2024-2027 and

employed for longer under their US Gulf absorb the large number of carriers on

-> EU rotations. While this was happen- order, which has exhausted the capacity

ing in Europe, the Far East saw very of the Korean yards until 2027. In the

muted demand for LNG due to healthy last 24 months, the price for a newbuild

stockpiles, a mild winter, and lower- 174,000cbm 2-stroke LNG carrier has

than-usual industrial power demand, risen by roughly $60 million compared

especially from China, which had not to the mid-high $180mil for a unit deliv-

lifted COVID-19 restrictions. Owing to ered in 2023 to the low $250mil for

its stronger pricing relative to the Far earliest delivery in 2027. Owners who

East (accounting for the cost of shipping have placed orders in time will be able

to either destination), Europe pulled to command significant premiums for

65% of US cargoes in October, 76% in long-term charters as charterers have

November, 75% in December and 72% in run out of options for modern carriers in

January, based on cargo data from Kpler. the front (2023-2026). Indicatively, the

As we leave this winter behind us and rate for a 10-year charter of a modern

look ahead to the mid and long-term, 2-stroke carrier with delivery in 2024

there are several elements which lend has risen YoY by nearly $25,000/day

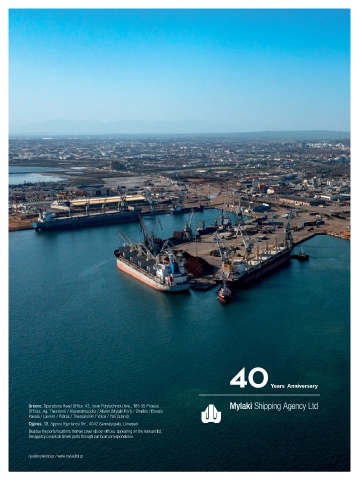

support to a bullish outlook for LNG from roughly mid $70s/day in Q1 2022 Greece. Operations Head Office: 43, Iroon Polytechniou Ave., 185 35 Piraeus

Offices: Ag. Theodoroi / Alexandroupolis / Aliveri (Mylaki Port) / Chalkis / Eleusis

shipping. Several US-based LNG liq- to low $100s/day in Q1 2023. In addition, Kavala / Lavrion / Patras / Thessaloniki / Volos / Yali (Island)

uefaction projects are on the cusp of Korean and Chinese yards are operating Cyprus. 38, Spyrou Kyprianou Str., 4042 Germasogeia, Limassol

reaching Final Investment Decisions at full capacity, and demand for modern Besides the ports/locations that we cover via our offices appearing on the relevant list,

(FIDs) and moving ahead with con- LNG carriers is only expected to grow the agency covers all Greek ports through our local correspondence.

struction. These new volumes will come with more production facilities receiving

ops@mylakiltd.gr / www.mylakiltd.gr

140